From the Toxic Torts and Environmental Law Committee

CERCLA’n the Wagons: Even as it Seeks to Expand PFAS Regulations, EPA Will Not Enforce Those Rules Against Certain Groups

By Todd Thacker

Since early 2022, the Environmental Protection Agency (“EPA”) has pursued authority to establish a rule designating PFAS (per- and polyfluoroalkyl substances) as “hazardous substances” under the Comprehensive Environmental Response, Compensation & Liability Act (CERCLA, also known as the “Superfund” Act). On August 12, 2022, the CERCLA PFAS designation effort advanced significantly when the Office of Management and Budget approved the EPA’s plan to designate PFOA and PFOS—perfluorooctanoic acid (PFOA) and perfluoroctane sulfonic acid (PFOS)—as hazards. This opened the door for the EPA to put forth its proposed designation of PFOA and PFOS under CERCLA and begin the required public-comment period.

Although the EPA has to this point proposed regulation of only PFOA and PFOS under CERCLA, in February 2023 the EPA sent a proposed rule to the Office of Management and Budget (“OMB”) stating that it planned to request public input on whether the agency should consider designating PFAS in addition to PFOA and PFOS as “hazardous substances” under CERCLA. The OMB reviewed this proposal and, on March 24, 2023, approved it, allowing the EPA to take another step forward in the rule-making process.

Also back in March, the EPA held a public listening session regarding concerns about potential liability under CERCLA. In April, the EPA published an advance notice of proposed rulemaking, seeking information to assist in the consideration of potential development of future regulations pertaining to PFAS under CERCLA.

The financial impact of such a designation could be profound. Once a substance is classified as a “hazardous substance” under CERCLA, the EPA can force parties it deems “polluters” to either clean up the polluted site or reimburse the EPA for the full remediation of the contaminated site. Even non-polluters could face considerable reporting requirements that would apply to companies anywhere in the PFAS’ stream of commerce. Obviously, the more PFAS the EPA designates, the more significant the cleanup and compliance costs.

But the EPA stated that it intends to focus on manufacturers, federal facilities, and other industrial parties whose actions result in the release of significant amounts of PFAS. On October 12, 2023, David Uhlmann, Assistant Administrator for the Environmental Protection Agency’s (“EPA”) Office of Enforcement and Compliance Assurance (OECA), stated that EPA will not pursue per- and polyfluoroalkyl substances (PFAS) enforcement actions against farmers who used biosolids, public airports and certain fire departments that used aqueous film forming foam (AFFF) for fire suppression, or municipal wastewater facilities, so long as they were acting in good faith.

Because the OMB has designated the proposed rule as “economically significant,” the EPA will have to conduct a Regulatory Impact Analysis (RIA) upon it. The RIA requires the EPA to show that a CERCLA designation is the least burdensome and most cost-effective way to achieve its goals. Some believe that the EPA already has an RIA in progress, and that its recent actions indicate its confidence that it can meet the RIA requirements for its proposed new policy.

The EPA’s proposed rule could result in staggering cleanup costs to industry, which could be responsible even for PFAs released by third parties. If no further exemptions prove forthcoming, this could place a particular burden on waste-management companies and water utilities already struggling to dispose of PFA-contaminated material under current regulatory guidelines.

According to the EPA, over 12,000 PFAS currently exist. If even a small fraction of those receive a CERCLA/Superfund designation, the financial consequences could easily become immense even for industries only tangentially related to PFAS manufacture or distribution. Given the EPA’s stated intent to hold all PFAS polluters of any kind accountable, every responsible company should review their practices for possible PFAS use and prepare a plan to respond to possible regulatory action.

Todd Thacker is an experienced litigator who represents clients in toxic tort, asbestos litigation, insurance coverage, and business and commercial matters. The California State Bar has certified him as an appellate specialist. Todd has directed and drafted numerous appeals and writs in California, both as an appellate and a respondent. He has appeared before the First, Second, Fourth, and Fifth District Courts of Appeal in California and federally before the Ninth Circuit. Todd also devotes a portion of his time to dispositive and other complex motion practice.

Todd Thacker is an experienced litigator who represents clients in toxic tort, asbestos litigation, insurance coverage, and business and commercial matters. The California State Bar has certified him as an appellate specialist. Todd has directed and drafted numerous appeals and writs in California, both as an appellate and a respondent. He has appeared before the First, Second, Fourth, and Fifth District Courts of Appeal in California and federally before the Ninth Circuit. Todd also devotes a portion of his time to dispositive and other complex motion practice.

Interested in joining the Toxic Torts and Environmental Law Committee? Click here for more information.

Print this section

Print the newsletter

Professional Liability: Riding the E&O Line

Questions about Damages in a Failure to Procure Case: Does a Third-Party’s Judgment Against the Client Serve as Actual Damages?

By Katrina L. Smeltzer and Samuel N. Sherman

Determining what the recoverable damages are against an insurance broker for failure to procure becomes complicated when the case involves a third-party’s judgment against the client, which the client in turn claims as her damages against the insurance broker. While there is some guidance in the law, recent trends from the plaintiffs’ bar have attempted to subvert that guidance and expand the damages available for a failure to procure. But at least a few courts have placed things back on track.

Here is a hypothetical for consideration:

- Client obtains an auto insurance policy issued by Insurance Carrier through Insurance Broker with limits of $100,000.

- Client subsequently causes an auto accident with Plaintiff, leading to severe injury to Plaintiff. Plaintiff files suit against Client.

- Insurance Carrier denies coverage, including a defense to Client.

- Plaintiff then obtains a $1,000,000 judgment against Client.

- Client later sues Insurance Broker claiming his negligence led to a lack of insurance coverage for Client.

The critical question in this hypothetical becomes what damages Insurance Broker can be held responsible for, assuming Client can prove Insurance Broker is at fault. Are Client’s damages against Insurance Broker limited to the $100,000 limits of the insurance policy he failed to procure for her? Or, may Client recover the entire $1,000,000 judgment Plaintiff has against her from Insurance Broker?

Several states only allow recovery from Insurance Broker up to the limits of the subject insurance policy. However, the overwhelming consensus of states that have addressed damages in a failure to procure case hold “[t]he proper measure of damages in an action against an agent for failure to procure insurance is the amount that would have been due under the policy if it had been obtained, plus any consequential damages resulting from the agent’s breach of duty[.]” 3 Couch on Ins. § 46:74; see also 10 Am. Jur. Proof of Facts 3d Insurance Agent’s or Broker’s Failure to Procure Ins. § 579 (1990); 49 Causes of Action 2d Cause of Action Against Insurance Agent or Broker for Failure to Procure Ins. § 1. This begs the question, however, what can be considered consequential damages from Insurance Broker’s acts and whether the amount of judgment in excess of the insurance policy limits can be considered consequential damages?

A series of cases in the 1980s arguably resolved this issue holding that if the Client’s damage at issue (i.e., the judgment) was caused by the very liability the insurance policy was meant to insure (i.e., liability from an auto accident), then the Client’s damage in excess of the policy limits was not a consequential damage. See e.g., Topmiller v. Cain, 657 P.2d 638 (N.M. Ct. App. 1983) (consequential damages awardable against an insurance broker do not include damages incurred “by reason of the occurrence of the contingency insured against (such as fire, theft, etc.) but by reason of [the insurance agent’s] breach of contract or negligent failure to secure coverage (such as loss profits due to unnecessary delay in obtaining reimbursement for the original loss)”); Glades Oil Co., Inc. v. R.A.I. Management, Inc., 510 So.2d 1192, 1195 (Fl. Ct. App. 1987) (third-party’s judgment was not a consequential damage because it was the “result of the contingency insured against, namely the negligence of the Glades driver resulting in injuries”); Kenyon v. Larson, 286 N.W.2d 759 (Neb. 1980) (limiting recovery against the insurance broker to the amount of the insurance despite that there was a third-party judgment against the client in excess of the insurance policy limit); Lee v. Andrews, 667 P.2d 919 (Mont. 1983) (as against insurance agent who failed to procure a policy, customer could not recover amount of judgment against customer more than relevant policy limits); see also J. Smith Lanier & Co. v. Southeastern Forge, Inc., 630 S.E.2d 404 (Ga. 2006) (the court refused to allow the agent to be liable for anything more than the limits of the respective policy).

If these cases are followed, then in our hypothetical from above, Client would be entitled to damages of $100,000 (i.e., the policy limits) as against Insurance Broker if she could prove his fault. Arguably, awarding the limits of the insurance policy at issue placed Client in the position she would have been in but for Insurance Broker’s negligence, which is the whole purpose of compensatory damages.

However, a new trend has emerged particularly in states that allow for insurance “rollovers,” in which Plaintiff and Client from the hypothetical above reach some resolution wherein Client agrees to a judgment against her (usually an exorbitant judgment) in exchange for a contractual agreement that Client will never be personally obligated to pay the judgment. In these situations, rather, Plaintiff agrees to limit recovery on the judgment to something such as (a) the insurance policy limits should a court ultimately find there was coverage under the policy, (b) recovery from an extra-contractual claim against Insurance Carrier, or (c) recovery from claims against Insurance Broker.

The question then becomes can Client claim any part of the judgment against her as damages in her case against Insurance Broker when Client is contractually relieved from ever personally paying the judgment? If the answer were “yes,” then arguably this creates a “bad faith” cause of action against Insurance Broker, much like such a cause of action against Insurance Carrier for bad faith failure to settle. But an insurance broker is not an insurance carrier and does not hold the same fiduciary obligations an insurance carrier holds.

The few courts that have addressed this situation held there is no such claim as a “bad faith” or an extra-contractual claim against an insurance broker like there is against an insurance carrier. See e.g., J. Smith Lanier & Co. v. Southeastern Forge, Inc., 630 S.E.2d 404 (Ga. 2006). These courts have also questioned whether the client sustained actual damages as is required to support a negligence, breach of contract, or breach of fiduciary duty claim because through a contractual agreement with the plaintiff, the client will never be personally liable for the judgment.

For example, in Espenschied Transport Corp. v. Fleetwood Services, Inc., the Utah Supreme Court addressed a case where the plaintiff and the client agreed the plaintiff would collect on the judgment only the amount the client recovered from the insurance broker and the client would never personally pay on the judgment. 422 P.3d 829, 831-32 (Utah 2018). The court found the client could not prove an essential element of its claim against the insurance broker, which was that the client had incurred actual damages. Id. at 834-36. Under their agreement, the client had not paid any of the judgment and never would—thus, the court reasoned, the client had not incurred any actual damages. Id. The court was also not convinced assignment of the claim against the insurance broker to the plaintiff was actual damages. Id. at 836. The court stated, “[w]e decline to conclude that a party has suffered an actual injury if their injury would only exist if they were successful in the lawsuit to recover for that injury.” Id.

Likewise, in an important case in Missouri (where “rollover” agreements are particularly prevalent), the Missouri Court of Appeals, Western District held (1) a broker could not be held liable for a “bad faith” claim like an insurance carrier and (2) a client could not prove actual damages from failure to procure if the client had no obligation on the very judgment claimed as damages. In Knockerball MidMo, LLC v. McGowan & Co., the court addressed a “rollover” situation where the client rolled on the insurance carrier who had denied coverage, allowing a judgment against the client in exchange for the plaintiff’s agreement he would only execute on the insurance policy and recover from the bad faith action against the insurance carrier. 667 S.W.3d 640, 642-43 (Mo. App. W.D. 2023). The plaintiff and client actually recovered part of the judgment from the insurance carrier and then the client pursued further recovery from the insurance broker. Id. at 643. In its opinion, the court was quick to note there is no recognized claim against an insurance broker for bad faith as there is against an insurance carrier in Missouri and that as a result, the claim against the insurance broker could not be treated like a bad faith claim against an insurance carrier. Id. at 644-45.

The court then noted the claims against the insurance broker for negligence, breach of fiduciary duty, and breach of the duty of loyalty all required the plaintiff to show actual damages. Id. at 645-46. The court concluded the judgment, which was the only damages claimed by the client, could not be actual damages because the client would never be personally liable for that judgment due to the contractual agreement with the plaintiff. Id. at 646-47. The court affirmed summary judgment in favor of the insurance broker. Id. at 646-48.

Accordingly, a few cases have addressed the emerging issue of these “rollover-type” agreements and how they interact with a failure to procure claim against an insurance broker. Thus far, they have given good guidance and relief to the insurance professional industry. Courts have refused to expand an insurance broker’s liability into that akin to the insurance carrier’s liability, appreciating that an insurance broker is not an insurance carrier.

Practitioners defending insurance brokers in failure to procure cases should quickly flush out the plaintiff’s claimed damages and if they are limited to the third-party’s judgment, then the practitioner should be prepared to seek dispositive relief.

Katrina L. Smeltzer is a shareholder at Sandberg Phoenix in Kansas City, MO. She is a business litigator, focusing her practice on representing professionals, assisting insurance companies with coverage decisions and resolving construction disputes. She also chairs the Professional Liability team at Sandberg Phoenix.

Katrina L. Smeltzer is a shareholder at Sandberg Phoenix in Kansas City, MO. She is a business litigator, focusing her practice on representing professionals, assisting insurance companies with coverage decisions and resolving construction disputes. She also chairs the Professional Liability team at Sandberg Phoenix.

Samuel N. Sherman is an associate at Sandberg Phoenix in Kansas City, MO. He is a member of the Business Litigation practice group, and focuses his practice on business, financial institutions, and insurance litigation.

Samuel N. Sherman is an associate at Sandberg Phoenix in Kansas City, MO. He is a member of the Business Litigation practice group, and focuses his practice on business, financial institutions, and insurance litigation.

Interested in joining the Professional Liability Committee? Click here for more information.

Product Liability: An Update from the PLC

Medicare Myth Busting: Mandatory Medicare Reporting Misconceptions & Mistakes: Part II

Penalties Defined: Section 111 Reporting Civil Money Penalty Final Rule Released

By Barrye Panepinto Miyagi and John Cattie

Executive Summary: After many years, CMS published its Final Rule on Civil Money Penalties. While CMS previously raised the prospect of penalizing organizations for erroneous data and various technicalities, the Final Rule is much more narrow in scope. Make no mistake, Group Health Plans and Non-Group Health Plans must take the Final Rule seriously and ensure that protocols are in place to timely submit Section 111 reporting required information. While the Final Rule represents the most significant Medicare Secondary Payer regulatory development in almost a decade, it simply reinforces the requirement for timely reporting, a rule that has been in place for over a decade.

Background

The Centers for Medicare & Medicaid Services (CMS) has finalized the long-awaited rule specifying how and when CMS will calculate and impose civil money penalties (CMPs) when Group Health Plan (GHP) and Non-Group Health Plan (NGHP) Responsible Reporting Entities (RREs) fail to meet their Medicare Secondary Payer (MSP) reporting obligations (CMP Final Rule). Background on the CMP Final Rule can be found in our prior article, Medicare Myth Busting: Mandatory Medicare Reporting Misconceptions & Mistakes: Part I – Civil Monetary Penalties: Who is the Responsible Reporting Entity? The text of the CMP Final Rule, as published at 42 C.F.R. § 402, can be found here.

The CMP Final Rule is effective as of December 11, 2023. The CMP Final Rule becomes applicable on October 11, 2024. RREs who are not compliant with their Section 111 reporting requirements by October 11, 2024, may be at risk for CMPs. The earliest date a penalty will be imposed is October 11, 2025.

Basis for CMPs

The sole basis for imposition of CMPs will be untimely reporting. Prior iterations of the CMP Final Rule provided for CMPs where there was contradictory reporting and/or where error tolerances were exceeded. Contradictory reporting and error tolerances are not included in the CMP Final Rule as a basis for CMPs.

GHPs: The CMP Final Rule defines timeliness as reporting to CMS within one (1) year of the date GHP coverage became effective.

NGHPs: The CMP Final Rule defines timeliness as reporting to CMS within 1 year of the date a settlement, judgment, award, or other payment determination was made (or the funding of a settlement, judgment, award, or other payment, if delayed), or the date when an entity’s Ongoing Responsibility for Medicals (ORM) became effective. Failure to terminate ORM is not a basis for a CMP.

Failure to timely report prevents CMS from promptly and accurately determining the proper primary payer and taking the appropriate actions. CMPs are designed to address this issue.

Commentary: RREs should breathe a sigh of relief. Obligations imposed by the CMP Final Rule are no broader that what has been required in prior years. In addition, in 2021, CMS implemented a Funding Delayed Beyond TPOC Start Date (TPOC Date) requirement. Where NGHP RREs delay funding thirty (30) days or more after the TPOC Date, a Funding Delayed date is required in the Section 111 report. This date effectively extends the deadline for the Section 111 report.

Procedure for Imposing CMPs

CMS will not monitor all RRE submissions as previously contemplated. Instead, CMS developed an audit process to identify noncompliance with the CMP Final Rule.

- CMS will audit a randomized sample of recently added beneficiary records. CMS has determined that it will be possible to audit a total of 1,000 records per calendar year across all RRE submissions, divided equally among each calendar quarter (250 individual beneficiary records per quarter).

- A proportionate number of GHP and NGHP records based upon the pro-rata count of recently added records will be evaluated. For example, if over the calendar quarter being evaluated, CMS received 600,000 GHP records and 400,000 NGHP records for a total of 1,000,000 million recently added beneficiary records, then 60 percent of the 250 records audited for that quarter would be GPH records and 40 percent would be NGHP records.

- At the end of each calendar quarter, CMS will randomly select the indicated number of records and analyze each record for compliance.

Be aware that insurers and self-insurers who fail to report (intentionally or not) do not escape scrutiny and a potential CMP. CMS may evaluate reports from other sources (such as beneficiary reporting of a final settlement) and CMS will validate that report with a matching RRE report. Where that matching report does not exist, the RRE is subject to a potential CMP.

How CMS Will Calculate CMPs

CMS will calculate penalties for GHPs and NGHPs differently. CMS lacks statutory authority to adjust the amount of penalties imposed on GHPs.

GHPs: For any selected record that is more than 1 year (365 calendar days) late, CMS will impose a penalty of $1,000 per day (as adjusted).

NGHPs: For any selected record determined to be noncompliant, CMS will implement a tiered approach to penalties.

To calculate the penalty imposed against an RRE, CMS will multiply the number of audited records found to be noncompliant by the number of days each record was late (in excess of 365 days). The product will then be multiplied by the appropriate penalty amount.

NGHP Tiered Penalty Approach:

For any record selected via the random audit process where the NGHP RRE submitted the information more than 1 year after the date of settlement, judgment, award, or other payment (including assumption of ORM for medical care), the daily penalty will be:

$250.00 for each calendar day of noncompliance where the record was reported more than one (1) year but less than two (2) years after the required reporting date.

$500.00 for each calendar day of noncompliance where the record was reported more than two (2) years but less than three (3) years after the required reporting date.

$1,000 for each calendar day of noncompliance where the record was reported three (3) years or more after the required reporting date.

Penalties are adjusted annually for inflation pursuant to 45 C.F.R. § 102.

CMP Safe Harbors Do Exist for Some

CMS will not impose a CMP if any of the following apply.

A. NGHP Good Faith Efforts to Obtain Identifying Information

CMS allows the NGHP RRE to make good faith efforts to obtain the individual’s name, date of birth, gender, Medicare Beneficiary Identifier (MBI), and Social Security Number (or last 5 digits). Here are the steps the NGHP must perform to qualify for a safe harbor:

1. RREs for the NGHP must communicate the need for the information to the individual and his/her attorney or other representative, if applicable, or both.

2. RREs must request the information from the individual and his/her attorney or other representative (if applicable) at least three times

a. Once in writing (including electronic mail);

b. Once more by mail; and

c. Once more by phone or other means of contact in the absence of a response.

3. If the RRE receives a written response from the individual or their attorney or representative that clearly and unambiguously declines or refuses to provide any portion of the required information, no additional communication is required of the NGHP RRE.

4. The RRE must maintain the documented refusal for at least five (5) years.

B. Technical or System Issues Outside of the RRE’s Control

If the untimely reporting by the RRE is the result of a technical or system issue outside of the control of the RRE, or that is the result of an error caused by CMS or one of its contractors, the safe harbor will apply.

C. Recent Policy or Procedural Change

If the NGHP or GHP noncompliance is due to a CMS policy or procedural change that has been effective for less than six (6) months following the implementation of that policy or procedural change (or for one (1) year if CMS failed to provide at least six (6) months’ notice before implementing the change), the safe harbor will apply.

D. Compliance with Reporting Thresholds or Reporting Exclusions

If the NGHP or GHP entity complies with any reporting thresholds or other reporting exclusions, the safe harbor will apply.

Observations and Additional Information

Pre-Existing CMS Guidance: CMPs do not alter prior CMS guidance. For example, the deadlines for Section 111 reporting remain the same. However, where an RRE’s Section 111 report is submitted over a year after the trigger to report, the RRE is subject to a potential penalty.

Prospective Application: CMS will evaluate compliance based only upon files submitted by the RRE on or after the effective date of the CMP Final Rule. CMS will only impose CMPs on instances of noncompliance based upon settlement dates, coverage effective dates or other operative dates (such as funding delayed dates) that occur after the effective date of the CMP Final Rule. The CMP Final Rule specifically states there will be no inadvertent or de facto retroactivity of CMPs.

Taking a closer look at the Final Rule, no penalty will be imposed until at least one (1) year after the later of: 1) the applicability of the CMP Final Rule (October 11, 2024); or 2) the coverage effective date, ORM Effective Date, TPOC Date, or Funding Delayed Date (if such date is reported with the TPOC Date).

Timeliness of Reporting: There is a possibility an RRE may receive notice of a potential penalty for untimely reporting ORM when the RRE could not have timely reported. Consider a case where the incident date is June 5, 2025. ORM is not accepted until December 5, 2026, but ORM is promptly reported. In this scenario, the report of ORM appears late because the Effective Date is always the date of incident. In these situations, the RRE should maintain documents which demonstrate the RRE’s review of the claim, when the RRE determined to assume ORM, as well as documents which outline why the ORM report was delayed.

Statute of Limitations: CMS has 5 years to enforce CMPs. CMS also takes the position that the 5-year statute of limitations begins to run from the date CMS discovers the noncompliance unless the RRE can prove that CMS should have known of the noncompliance.

Appeals: CMS will follow the formal appeals process set forth in 42 C.F.R. § 402.19 and 42 C.F.R. § 1005. An informal notice (described as a written pre-notice) will precede the formal notice of the CMP. The RRE will have 30 days to respond with mitigating factors before CMS issues the formal written notice. CMS encourages RREs to submit all mitigating factors, and does not impose strict limits on acceptable documentation for those purposes.

Total Annual CMPs: CMS calculated penalties based upon the methodology set forth above for the 2022 calendar year. CMS calculated the maximum penalties imposed would have been $86.4 million for GHPs and $42.4 million for NGHPs for a total amount of $128.8 million (which is below the $200 million threshold to be considered an economically significant rule). Based upon this information, GHPs appear to currently have double the risk for CMPs purely from a financial perspective.

Double Damages and Interest for Failure to Reimburse Medicare: The penalties addressed in the CMP Final Rule pertain to Section 111 reporting only. The Medicare Secondary Payer Act (MSPA) statutory provisions have not been amended or revised. The potential for double damages and interest for failure to properly and timely reimburse Medicare for conditional payments made by Medicare remains in place. The CMP Final Rule is expected to aid CMS in identifying conditional payment reimbursement situations more accurately and effectively.

MSP Termination Date for GHPs: The CMP Final Rule does not impose penalties for failure to enter an MSP Termination Date.

Stay Tuned for Future Developments

CMS will develop and publish additional guidance related to CMPs. Questions should be directed to the new CMS Section 111 CMP mailbox at Sec111CMP@cms.hhs.gov. CMS has indicated submitters may not receive responses. CMS will use questions and comments for outreach and educational materials. CMS will post guidance and updates, including information about webinars, on the CMS.gov website.

Disclaimer: This article is accurate as of November 21, 2023, and is intended for general information purposes only. Information posted is not intended to be legal advice.

Barrye Panepinto Miyagi is a Partner at the law firm of Taylor Porter and the Practice Group Leader for Taylor Porter’s MSP Compliance Group. Barrye is certified as an MSP Fellow, and she works in all areas of MSP compliance. She has over 25 years of litigation experience and over 15 years of experience in the MSP arena. Barrye is the vice chair of DRI’s MSP Task Force. She received her BS and her JD from Louisiana State University.

Barrye Panepinto Miyagi is a Partner at the law firm of Taylor Porter and the Practice Group Leader for Taylor Porter’s MSP Compliance Group. Barrye is certified as an MSP Fellow, and she works in all areas of MSP compliance. She has over 25 years of litigation experience and over 15 years of experience in the MSP arena. Barrye is the vice chair of DRI’s MSP Task Force. She received her BS and her JD from Louisiana State University.

John Cattie is the Managing Member of Cattie & Gonzalez, P.L.L.C. He focuses his legal practice on Medicare Secondary Payer issues, including mandatory insurer reporting, conditional payment resolution, and future medical exposure/Medicare Set-Asides. He is a past chair of DRI’s MSP Task Force, serving as Executive Editor for DRI’s Defense Practitioner’s Guide to Medicare Secondary Payer Issues. He received his BA from the University of North Carolina and his JD/MBA from Villanova University.

John Cattie is the Managing Member of Cattie & Gonzalez, P.L.L.C. He focuses his legal practice on Medicare Secondary Payer issues, including mandatory insurer reporting, conditional payment resolution, and future medical exposure/Medicare Set-Asides. He is a past chair of DRI’s MSP Task Force, serving as Executive Editor for DRI’s Defense Practitioner’s Guide to Medicare Secondary Payer Issues. He received his BA from the University of North Carolina and his JD/MBA from Villanova University.

Asbestos: The Devil Is in the Dose II; It’s as Simple as A, B, E!

By Edward R. Hugo and Bina Ghanaat

DRI published Asbestos: The Devil is in the Dose in the July/ August 2023 edition of The Brief Case. The Commentary focused on the legal standard for establishing causation in asbestos cases, with an emphasis on the applicable Federal Law:

Under Federal Maritime Law, the seminal case of McIndoe v Huntington Ingalls, Inc., 817 F.3d 1170, 1176 (2016) implemented a “substantial factor” test, holding that: “Absent direct evidence of causation, a party may satisfy the substantial factor test by demonstrating that the injured person had substantial exposure to the relevant asbestos for a substantial period of time.” (Edward Hugo argued the McIndoe case before the United States Court of Appeals, Ninth Circuit, on August 31, 2015).

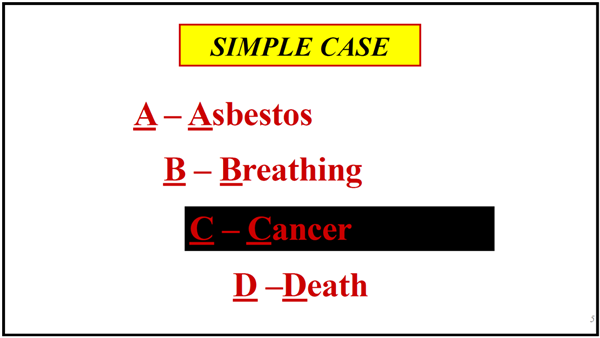

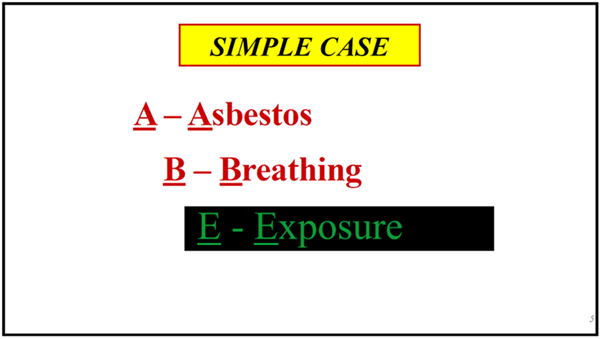

Fast forward to our last trial, where we objected to plaintiff’s counsel’s submission of the following slide as part of their proposed PowerPoint opening.

We objected, and the Court agreed, that the foregoing was improper argument during opening statement:

MR. HUGO:

An example, ABCD, Asbestos Breathing Causes Death. That is one of the slides.

THE COURT:

That is an argument.

MR. HUGO:

No kidding. That is why I am bringing it to your attention.

THE COURT:

I agree with you. If it’s a closing argument, you can’t make an opening statement in the guise of a closing argument.

MR. FROST:

Your Honor, I’m going to be very clear with the Court. The evidence will be asbestos breathing causes cancer and death. That is what the evidence is going to be, that is not an argument.

I mean, that is what the evidence will be, and there will be no dispute about this, that asbestos – breathing asbestos causes cancer and death in this case.

THE COURT:

That is false. Not every breathing asbestos causes death. There have been millions and millions of people who have been exposed to asbestos, has breathed asbestos and that has not caused their death. So therefore, you are making that argument.

Counsel, I mean, I’m shocked when you say something of that sort. Maybe that gets you by other judicial officers, I’m not doing that.

You can make an argument that in this particular case, we will show that the decedent breathed asbestos, and that is asbestos caused his death. That is fine, but don’t make these slogans, don’t make these arguments. It’s an opening statement.

I will allow you to make that argument in your closings, you are not going to be able to do that in an opening statement, period. Is that understood?

It should be by now.

Dennis v. Air & Liquid Corp. Case No. CV 19-9343. USDC, Central District of California, 11/6/23, 21:6-22:12

The Court later noted that in addition to being argumentative, the foregoing PowerPoint slide was contrary to the federal causation standard set forth in McIndoe v. Huntington Ingalls, Inc., 817 F.3d 1170 (2016):

THE COURT:

Okay. We are here for a lot of stuff before I bring the jury in. First of all, reflecting more on the little – I don’t know what you call it, ABCD?

MR. FROST:

Yes, Your Honor.

MR. HUGO:

Rhetoric.

THE COURT:

When you use some abbreviation, the other problem I have, I thought about it some more, that little ABCD is contrary to the holding in McIndoe versus Huntington Ingles, 817 F.3d 1170, so I will note that as well.

Dennis v. Air & Liquid Corp. Case No. CV 19-9343. USDC, Central District of California, 11/7/23, 5:12-21

The Judge was on point! And, with a focused and firm cross examination, the critical distinction between exposure to a naturally occurring mineral and the specific causation of plaintiff’s disease can be made with plaintiff’s own experts.

...

“Q. And you told [plaintiff’s counsel] that there is no risk, and I want to be clear -- absolutely none, zero, zip, nada -- risk of mesothelioma from background levels of exposure that we as human beings have, correct?

A. Well, none has ever been measured, let's put it that way. I can't say nada. I can't say it's never happened because there could be some very high-susceptible individuals who have developed mesothelioma, but it wouldn't have been recognized as such. So that -- that's my answer.

Q. There's no measured risk with --

A. As I've said --

Q. -- background exposure to asbestos, true?

A. As I've said.

Q. And you've testified in multiple trials in multiple states that background levels range from 0.03 up to a high of 0.01 fibers per cc, correct?

A. So 0.03 is a very high background. If I've seen that and said so, that's fine. I mean, that can happen outside of a mine or shipyard, but that's not a typical background. The typical backgrounds have two zeros, .003 or 6 up to four or five zeros. So that's much more typical than what you're saying.”

Id., 10/27/23, Trial preservation deposition of Arnold Brody, Ph.D., 85:21-86:19

...

Q. Now, with regard to the human body's defense mechanisms, I think you've testified on direct examination that 95 percent of pollutants are removed. But when it comes to asbestos, 98 or 99 percent of asbestos that we breathe in is removed, correct?

A. On the upper airways, that's fine, 95 -- depends on the study but, yeah, 95, 98, 99, that's fine.

Q. And people who live in urban environments like Los Angeles and are adults would have millions or even billions of asbestos fibers in their lungs and are not at any risk of mesothelioma, correct?

A. Yeah, you know, you can get a billion fibers into a thimble, but that's really not a whole lot but, yes, what you say is correct.”

Id., 10/27/23, Trial preservation deposition of Arnold Brody, Ph.D., 90:16-91:4

Conclusion

All things are poison and nothing is without poison: the dosage alone makes it so a thing is not a poison. “Die dritte Defension wegen des Schreibens der neuen Rezepte”, Septem Defensiones 1538.

A substance’s harmful effect within the human body only occurs when it reaches susceptible cells in a high enough concentration. Although it is a simple concept, from the defense perspective it is critical to distinguish exposure from causation.

Edward R. Hugo is a trial attorney, appellate lawyer, litigator and litigation manager for cases involving products and premises liability, toxic torts, environmental claims, construction defect, personal injury, wrongful death, insurance, professional negligence, sexual molestation and criminal law. He has also been retained as an expert witness and testified in trial, arbitration and deposition regarding: the duties of defense counsel, the effectiveness of defense strategies, the reasonableness of settlement values and defense costs, and insurance coverage issues.

Edward R. Hugo is a trial attorney, appellate lawyer, litigator and litigation manager for cases involving products and premises liability, toxic torts, environmental claims, construction defect, personal injury, wrongful death, insurance, professional negligence, sexual molestation and criminal law. He has also been retained as an expert witness and testified in trial, arbitration and deposition regarding: the duties of defense counsel, the effectiveness of defense strategies, the reasonableness of settlement values and defense costs, and insurance coverage issues.

Bina Ghanaat is a Partner with experience in toxic torts, insurance coverage, bad faith, habitability, and personal injury cases. She manages her cases from inception to resolution, handling discovery, depositions, law and motion, and trial preparation in state and federal courts. Ms. Ghanaat has defended a wide range of clients, including manufacturers, suppliers, contractors, insurance carriers, building owners, and trucking companies. She has drafted numerous motions for summary judgment that have resulted in dismissals of her clients or significantly reduced demands. She has also drafted and argued successful motions for summary adjudication as to punitive damages and various causes of action in asbestos matters venued in San Francisco and Alameda. For those cases in which a dispositive motion has not been viable, Ms. Ghanaat has prepared them for trial in an efficient manner with an emphasis on achieving optimal results for her clients. In Fall 2020, Ms. Ghanaat was co-counsel in one of the first “virtual” trials in Alameda County.

Bina Ghanaat is a Partner with experience in toxic torts, insurance coverage, bad faith, habitability, and personal injury cases. She manages her cases from inception to resolution, handling discovery, depositions, law and motion, and trial preparation in state and federal courts. Ms. Ghanaat has defended a wide range of clients, including manufacturers, suppliers, contractors, insurance carriers, building owners, and trucking companies. She has drafted numerous motions for summary judgment that have resulted in dismissals of her clients or significantly reduced demands. She has also drafted and argued successful motions for summary adjudication as to punitive damages and various causes of action in asbestos matters venued in San Francisco and Alameda. For those cases in which a dispositive motion has not been viable, Ms. Ghanaat has prepared them for trial in an efficient manner with an emphasis on achieving optimal results for her clients. In Fall 2020, Ms. Ghanaat was co-counsel in one of the first “virtual” trials in Alameda County.

Interested in joining the Product Liability Committee? Click here for more information.

Alternative Dispute Resolution: ADR Choices

The Importance of Efficiency in Mediation

By Jeff Trueman, Esq., LL.M

When it comes to obtaining a good outcome for clients relative to resource management, settlements usually provide outcomes more efficiently than litigation. Typically, the earlier the resolution, the better for everyone concerned. On the plaintiff side, clients and law firms can net more money without investing much into the case. On the defense side, higher legal costs do not ordinarily decrease indemnity payouts. Unfortunately, when either or both sides overplay their hands or believe they must engage in discovery before negotiating, inefficiency can creep in and take over. Before you know it, you’re a year or two into the litigation and no one’s talked to the other side to find out what they really want.

For lawyers, efficiency can be measured with metrics such as the lifecycle of the firm’s caseload, the percentage of cases settled within the first 90 days, the percentage of cases settled without depositions or a dispositive motion, and the average legal cost compared to the average settlement amount. An increasing number of institutions are asking counsel for these performance metrics.

Despite counsel’s best efforts, sometimes cases are not settled until the eve of trial. Who’s to blame when cases settle later than they should? Usually, each side blames the other. But the truth is either side can lead the way to greater efficiency. Good negotiators find a way to engage the other side and get around the complexities of a case. This includes an early assessment or resolution strategy that finds something of interest to the other side that will motivate them – not compel them - to talk.

A personal touch can make this happen. Pick up the phone and call the other side. Don’t hide behind email. Build credibility by conceding obvious issues in your case. Ask big-picture, open ended questions, inviting the other side to talk about whatever is important to them. And then listen - I can’t stress that enough. Most lawyers and claims professionals are dying to talk about how great their case is, but they fail to appreciate what the other side really wants.

One tradition that leads to inefficiency is the belief that a demand is needed from the plaintiff before an offer can be made from the defense. First of all, the manner in which a demand is requested may influence the amount demanded. Second, there is no rule about who goes first. A strong opening offer that is within your expected payout is not giving anything away if it serves a broader strategy. In other words, have a plan to bring about cooperation or identify when and how you will exit the discussion if the other side prefers to compete. The first one to show how serious they are about negotiating in good faith controls the board.

Managing impasse is another area where inefficiency can emerge. If and when you encounter impasse, ask yourself and your team, “What are we really fighting about at this point?” Greed and overconfidence can influence all participants. Rather than ask yourself what a jury is likely to do based on your experience, perhaps the question is what an emotional, irrational group of people will think about your client. Perhaps liability does not drive the case’s value as much as the damage potential. We all know that if the plaintiff’s likable, liability may be found against the defense more readily. And claimants who appear to be overplaying their hand are not likeable.

There are many ways to restart settlement talks after impasse. Additional information may need to be provided or exchanged. Joint discussions among counsel may generate additional movement, assuming they have mutual respect for one another. Consider exchanging short, written case summaries that include the last demand and offer. Perhaps a high-low agreement can be negotiated. Your mediator will likely have ideas as well. Keep in mind that shifting eye contact, changes in voice pitch or pacing, or some other physical change in demeanor may indicate bluffing, especially when the last 10% is up for grabs.

Efficiency comes from the right approach and mindset. Toward that end, ask yourself are you looking for ways to refine and improve your negotiation skills? Should you change your settlement strategy? When should you negotiate with the other side directly or engage in mediation?

Regardless of training or how much we work to refine our skills, we need to keep the big picture in mind, especially when things heat up. In our work, it’s easy to allow emotions or tradition to take the driver’s seat. But please don’t forget that efficiency is one of the main reasons why everyone comes to the table in the first place.

Jeff Trueman, Esq., is an independent mediator and adjunct professor at the Pepperdine Caruso School of Law and the University of Maryland Francis King Carey School of Law. He can be reached at jt@jefftrueman.com.

Jeff Trueman, Esq., is an independent mediator and adjunct professor at the Pepperdine Caruso School of Law and the University of Maryland Francis King Carey School of Law. He can be reached at jt@jefftrueman.com.

Interested in joining Alternative Dispute Resolution Committee? Click here for more information.

Young Lawyers: Raising the Bar

That Don’t Impress Me Much! Recent Eleventh Circuit Decision Weighs in on Whether Paying Off a Class Can Moot a Class Action, with Fourth Circuit Law Remaining Inconclusive

By Chelsea Pieroni and Christopher Rhodes

While perhaps rare, directly paying off a named plaintiff and putative class members before class certification is one tactic for potentially nipping a class action in the bud. It can be effective when both parties are willing to play ball and negotiate a settlement. However, a recent Eleventh Circuit decision sheds light on a tricky obstacle to mooting a class action this way. This article will summarize that recent decision, its analysis of the pick-off exception, and the extent of the Fourth Circuit’s jurisprudence on this issue.

For starters, about seven years ago, Campbell-Ewald Company v. Gomez, 577 U.S. 153 (2016), held that a defendant cannot unilaterally moot a claim by offering to provide the plaintiff the relief sought if the plaintiff rejects the defendant’s offer because an unaccepted settlement offer does not divest the plaintiff’s interest in the case. Since Campbell-Ewald, courts have been split on whether actual payment of full relief moots a class action.

Several years ago, our colleague analyzed Chambers v. Moses H. Cone Memorial Hospital, where the North Carolina Supreme Court held that a plaintiff whose individual claim was mooted by the defendant’s action may continue to represent a putative class where (1) the mooting event occurred before the plaintiff had a fair opportunity to seek class certification and (2) the plaintiff has not “unduly delayed” litigating class certification. Check out more on that case here.

This year, the Eleventh Circuit weighed in. The Eleventh Circuit’s decision in Sos v. State Farm Mutual Automobile Insurance Company considered a set of facts in which the defendant likely did not offer full relief. No. 21-11769, (11th Cir. 2023). The Eleventh Circuit held that regardless of whether State Farm successfully mooted Sos’s individual claims, Sos retained standing to pursue the class claims via the pick-off exception. In other words, under Sos, a diligent plaintiff may overcome a presumption of pre-certification mootness, even if the defendant has tendered full relief, if the court determines that the defendant is capable of picking off the named plaintiff’s claims.

State Farm Pays Off Class Members in Hopes to Avoid Class Certification

In Sos, an insurance company argued that it had mooted the named plaintiff’s and the putative class’s claims by offering incomplete remediation payments to each putative class member before the district court’s ruling on class certification and despite the named plaintiff’s rejection of the payments.

The relevant factual background of Sos is as follows: Anthony Sos got into an accident in his leased car, which was covered by a State Farm insurance policy. State Farm declared the car a total loss and issued a settlement payment that included less than the full amount for title transfer fees. Mr. Sos filed a putative class action lawsuit on behalf of himself and all others similarly situated, claiming that State Farm failed to pay appropriate sales tax and title fees on leased vehicle total loss claims in Florida.

State Farm attempted to remediate Mr. Sos’s claims individually and the claims of the putative class. First, State Farm sent a check to Mr. Sos’s attorney covering the full value of the insured driver’s claims for taxes, title fees, prejudgment interest, and attorney’s fees. State Farm also included a letter stating it expected Mr. Sos to accept the check as a settlement offer and, in return, dismiss the suit. Mr. Sos refused and responded that he would only be willing to discuss a settlement on a class-wide basis. State Farm did not respond to this offer.

Meanwhile, State Farm engaged in unilateral remediation with putative class members by sending them checks for underpaid taxes and title transfer fees. Notably, those payments did not include amounts for attorney’s fees or prejudgment interest.

The district court scheduled a status conference on class certification. A day before the status conference, State Farm sent another settlement payment check to Mr. Sos’s counsel. During the status conference, State Farm argued that its delivery of a second check mooted Mr. Sos’s claims as well as the putative class claims. After an additional hearing on the class certification issue, the district court granted in part the renewed motion for class certification and eventually concluded that the class satisfied all applicable Rule 23 requirements.

The Eleventh Circuit Rejects Attempt to Moot Class Certification by Paying Off Class Members

State Farm appealed the class certification order, contending its payments to the class members mooted the class action. The Eleventh Circuit affirmed the district court’s decision. The Eleventh Circuit reasoned that despite its efforts, State Farm’s remediation payments did not fully compensate all class members, State Farm did not pay any prejudgment interest and did not accord class members complete relief necessary to moot the class claims. Further, as discussed in more detail below, the Eleventh Circuit held that State Farm did not moot Mr. Sos’s claims or those of the putative class because Sos retained standing under the relation back doctrine.

Normally, a putative class action becomes moot if no named plaintiff with a live claim remains at the time of the district court’s class certification order. If the named plaintiff’s claims are mooted before a class is formally certified, there are no justiciable claims before the court, and thus the case should be dismissed.

However, courts have made exceptions to the mootness analysis. If one of these exceptions applies, class certification “relates back” to the filing of the complaint, giving the named plaintiff standing to pursue certification despite the intervening mootness of his individual claim. The Eleventh Circuit explained that in order to avoid the general presumption of mootness in these circumstances, two requirements must be met. First, the defendant must be capable of picking off the named plaintiff’s claims, and, second, the named plaintiff must be diligent in pursuing the class claims.

Here, both requirements were met. The record showed that State Farm tried to pick off Sos’s case and evade class certification from the very beginning of the litigation by making multiple offers, though clearly insufficient, to settle the claims with Sos individually and with putative class members. The record also showed that Sos had diligently pursued the class claims over the course of six years by personally participating in discovery and mediation and complying with all the district court’s filing deadlines.

The Eleventh Circuit also noted important public policy reasons for invoking the relation back doctrine in circumstances like these. Allowing a class’s claims to be picked off by a defendant’s tender of judgment before an affirmative ruling on class certification would frustrate the objectives of a class action. Moreover, without an exception to the mootness analysis, district courts could avoid certifying meritorious class actions simply by entering judgment for named plaintiffs before addressing class certification. Ultimately, this approach would conflict with the Supreme Court’s instruction in Campbell-Ewald that a potential class representative must be accorded a fair opportunity to show that certification is warranted.

Coming Up Short: The Fourth Circuit’s Coverage of the Pick-Off Exception

Closer to home, the Fourth Circuit has not squarely addressed whether actual payment of full relief moots a potential class action. It came close to doing so in Bennett v. Office of Federal Employee’s Group Life Insurance, 683 F. App’x 186 (4th Cir. 2017), an unpublished per curiam decision. In Bennett, former Judge James Beaty, Jr. of the Middle District of North Carolina found that MetLife’s offer of settlement, which included a check for the benefits of the named plaintiff in the full amount she asserted she was due, mooted the plaintiff’s claims. When Judge Beaty made this decision, however, Campbell-Ewald had not yet been issued. Applying Campbell-Ewald, the Fourth Circuit concluded that the plaintiff’s claims were not moot but did not expound on its reasoning.

The Fourth Circuit has not addressed whether actual payment of full relief moots a claim. Accordingly, district courts in the Fourth Circuit continue to navigate the current circuit split themselves, with some contributing to the ongoing conversation. In Fernandez v. RentGrow, Inc., 341 F.R.D. 174, 205 (D. Md. 2022), for example, Judge James Bredar stated, citing Bennett, that “it is inappropriate for the Court to say whether a settlement offer is complete when a plaintiff’s recovery might include punitive damages.”

More recently, in Hernandez v. KBR, INC., 2023 WL 3355332, at *8 (E.D. Va. 2023), Judge Henry Hudson—citing circuit and district court decisions from across the nation—concluded that, although the defendants paid the Department of Labor amounts owed to the plaintiffs for unpaid wages, the plaintiffs were “still entitled to seek judgment against [the defendants].” Judge Hudson also noted that full relief likely was not tendered because of plaintiffs’ ability to recover attorneys’ fees and costs under the applicable statute.

Conclusion

Attempts to moot a class action outside the settlement process may not make the class action go away at all, as the Supreme Court has made clear that a defendant cannot unilaterally moot a claim by offering to provide the plaintiff the relief sought when the plaintiff rejects the defendant’s offer. If a defendant would like to increase its chances of mooting claims with a plaintiff or putative class, the defendant should carefully assess the amount alleged in damages, any other statutory bases for monetary relief, and the jurisdiction’s rule on assessing attorney’s fees.

Chelsea Pieroni is a litigation associate at Ellis & Winters LLP where her practice focuses on complex commercial litigation, appellate litigation, and intellectual property law.

Chelsea Pieroni is a litigation associate at Ellis & Winters LLP where her practice focuses on complex commercial litigation, appellate litigation, and intellectual property law.

Christopher Rhodes is a litigation associate at Ellis & Winters LLP where his practice focuses on complex commercial litigation and tort matters, including product liability defense and general liability claims.

Christopher Rhodes is a litigation associate at Ellis & Winters LLP where his practice focuses on complex commercial litigation and tort matters, including product liability defense and general liability claims.

The Eleventh Circuit Speaks Firmly on Calculating Attorneys’ Fees: Look to the Local Community and Mind Your Multipliers

By Chelsea Pieroni and Christopher Rhodes

In a previous article, we covered Sos v. State Farm Mutual Automobile Insurance and analyzed the pick-off exception under Eleventh and Fourth Circuit case law. No. 21-11769 (11th Cir. 2023). Sos involved another issue of significance: the calculation of attorneys’ fees, which is the subject of this article.

The District Court Fumbles the Ball in Calculating Attorneys’ Fees

After deciding the parties’ summary judgment motions, the U.S. District Court for the Middle District of Florida referred the calculation of attorneys’ fees to a magistrate judge. The magistrate judge recommended that the district court grant in part the amount of attorneys’ fees requested by the plaintiff, reducing the requested hourly rates. In turn, the district court adopted the magistrate’s recommendation in part, rejecting the rate reduction and applying a national market standard.

On appeal, the Eleventh Circuit held that the district court abused its discretion as to attorneys’ fees. Additionally, the Eleventh Circuit concluded that the “federal lodestar approach,” applied by Florida law, should have been applied in this case. Under the federal lodestar approach, courts calculating attorneys’ fees must: (1) determine the number of hours the attorney(s) reasonably expended; (2) multiply that number by a reasonable hourly rate; and—where a contingency fee is at issue, such as in Sos—(3) consider whether to apply a multiplier.

The Eleventh Circuit held that the district court appropriately determined the number of hours reasonably expended, but abused its discretion by applying “the wrong legal standard” in determining a reasonable hourly rate. Under Florida law, courts consider various factors to determine a reasonable hourly rate, the most critical of which is the “going rate” in the community, i.e., the prevailing market rate where the suit was filed. The district court departed from this standard, reasoning that a “national market standard” applied due to the specialized nature of commercial class action law.

The Applicable Market: Rooted in Geography, Not Practice

The district court purported to follow the Seventh Circuit, which stated in Jeffboat, LLC, v. Director, Office of Workers’ Compensation Programs, 553 F.3d 487, 490 (7th Cir. 2009), that the relevant community for calculating reasonable hourly rates may sometimes be “a community of practitioners” rather than the local market area, “particularly when . . . the subject matter of the litigation is one where the attorneys practicing it are highly specialized and the market for legal services in that area is a national market.” Controlling law, however, tells a different story; as the Eleventh Circuit explained, Florida law provides that the community of the location in which the case was filed—in this case, Central Florida—is the only relevant community.

Interestingly, as an additional factor in calculating reasonable hourly rates in Sos, the district court also considered the rates previously approved as reasonable for the same attorneys doing the same type of commercial class action litigation throughout the state of Florida and in the U.S. District Court for the Middle District of Florida. That alone, the Eleventh Circuit concluded, was sufficient to warrant reversal because courts applying the federal lodestar method are prohibited from giving “controlling weight” to prior awards. Other circuit courts, the Second and Fourth Circuits among them, also follow this rule. See, e.g., E. Associated Coal Corp. v. Dir., Off. of Workers’ Comp. Programs, 724 F.3d 561, 573 (4th Cir. 2013); Farbotko v. Clinton County, 433 F.3d 204, 209 (2d Cir. 2005).

Choose Your Multipliers Wisely

The Eleventh Circuit also held that the district court abused its discretion in calculating the “maximum multiplier.” Under Florida law, courts must consider three factors to determine whether to apply a contingency fee multiplier in an insurance contract dispute: “(1) whether it is necessary to obtain competent counsel; (2) whether the attorney could mitigate the risk of nonpayment;” and (3) whether factors such as the novelty or difficulty of the question involved, time limitations incurred, and the experience and reputation of the attorney apply. The decision to apply a multiplier rests soundly in the trial court’s discretion—no showing of exceptional circumstances is necessary. If a court chooses to apply a multiplier, under Florida law it has three options: (a) if success was more likely than not at the outset of the case, a multiplier of 1 to 1.5 is appropriate; (b) if the likelihood of success was approximately even at the outset, 1.5 to 2.0 is appropriate; (c) if success was unlikely at the outset, a multiplier of 2.0 to 2.5 is appropriate.

The Eleventh Circuit concluded that the district court’s application of a multiplier was warranted because the case was novel and complex, the attorneys were likely to incur significant costs during the litigation, attorneys litigating in federal court are generally “unlikely to recover costs expended on expert testimony,” there was a high likelihood of no recovery, and “State Farm is known to be a voracious litigator with virtually unlimited resources.” However, the district court erred in concluding that the maximum allowable multiplier of 2.5 was appropriate, because the record did not support a finding that success was unlikely at the outset of this case.

The district court had concluded that success was unlikely because of State Farm’s “vigorous defense and intent to appeal,” the fact that plaintiff’s theory of liability had never been tested in the courts, and the “enormous outlay of capital, time and skill that advancing this theory . . . would require.” The Eleventh Circuit reasoned that, although these factors would have warranted a conclusion that success was “not likely” at the outset, they were insufficient to conclude that success was unlikely. These circumstances were not unique, and thus nothing in this case warranted application of the extreme end of the multiplier spectrum. Accordingly, the Eleventh Circuit reversed and remanded in part, with specific instructions to recalculate the award of attorneys’ fees.

The Fourth Circuit’s Multi-Factored Approach to Attorneys’ Fees

If you cannot get enough of attorneys’ fees calculations, you can read our recent post addressing a Ninth Circuit’s decision explaining how to calculate attorneys’ fees, as well as a comparative discussion on the Fourth Circuit’s own standard, here. In a nutshell, the Fourth Circuit has endorsed a three-part standard for its own application of the lodestar approach. In re Lumber Liquidators, 27 F.4th 291, 303 (4th Cir. 2022). First, the court applies a 12-factor analysis—which includes time and labor expended, attorney’s expectations at the outset of the litigation, and attorneys’ fees awards in similar cases—to determine reasonable hours and rates. Next, the court subtracts fees for hours spent on unsuccessful claims. Finally, the court awards a percentage of the remainder based on the degree of success for the plaintiff.

Courts employing the lodestar method are allowed—though not required—to use the percentage-of-recovery method as a check, and vice versa. However, at least as recently as 2022, the Fourth Circuit has rejected a hard-and-fast rule to determine when a percentage becomes unreasonable.

Conclusion

Although you may not need an advanced degree in mathematics to calculate attorneys’ fees, the Eleventh Circuit has reiterated that, under a federal lodestar approach, getting your numbers right—and digging in on the applicable factors under governing law—is key. In Sos, the district court did not err in concluding that an award of attorneys’ fees was warranted, but it abused its discretion in calculating them; it should have applied the market standard of the location of the suit, and should have been more careful in applying a multiplier. From the defense attorney perspective, Sos serves as yet another reminder of the hurdles practitioners may face when a court rules for them to pay up.

Chelsea Pieroni is a litigation associate at Ellis & Winters LLP where her practice focuses on complex commercial litigation, appellate litigation, and intellectual property law.

Chelsea Pieroni is a litigation associate at Ellis & Winters LLP where her practice focuses on complex commercial litigation, appellate litigation, and intellectual property law.

Christopher Rhodes is a litigation associate at Ellis & Winters LLP where his practice focuses on complex commercial litigation and tort matters, including product liability defense and general liability claims.

Christopher Rhodes is a litigation associate at Ellis & Winters LLP where his practice focuses on complex commercial litigation and tort matters, including product liability defense and general liability claims.

Interested in joining Young Lawyers Committee? Click here for more information.

Young Lawyers: Raising the Bar (Cont.)

New Years Resolutions and Goals for Young (and Older) Lawyers

By Brianna Weis

As we prepare to ring in the new year, ‘tis the season to review the past and set goals/resolutions for the new year. Often, we fail to consider our professional goals due to the monotony of our 9-5. As attorneys, especially young attorneys, reviewing and setting professional goals are just as important as personal/fun goals.

To set realistic future goals, we must look to the past. Frequently, we remember our losses more than our wins. It is important to look over the past year and list the projects/cases/tasks that you have contributed to over the past calendar/billable year. This will not only remind you of how far you have come, but also give you the ability to advocate for yourself at an end-of-year review. By starting this practice early in a career, you will have a master of list of all your contributions to the firm which you can utilize when you are being evaluated for partner (or a promotion to senior counsel). A master project list should also include membership/contribution to defense organizations, publication/speaking opportunities, and contributions/membership to in-firm committees.

Your master project list may highlight gaps or deficiencies in your resume. It could be something as simple as not having the opportunity to draft discovery or something as complex as not having the opportunity to attend/chair a trial. A simple and tangible goal for the next year can be asking for those types of projects. Trials are often staffed by seniority but notify your senior associates/partners on your cases that you want to attend trial and ask what the skills/first steps you need to accomplish to be considered for a trial chair. This will allow you to craft a practical short-term goal to achieve your long-term goal of attending trial.

Additionally, make sure your case list is up to date. Even if you only helped cover a deposition or a hearing, make sure that you have it noted on a list. This will help you manage your case load and be able to advocate for additional cases. If in your review of the year, you determine that a transfer to another firm is necessary, you will need an up-to-date case list for a conflict check.

As you review your cases/projects over the year, evaluate whether they are in the practice area that you want to focus on in your career. Young lawyers are often staffed on one team based on the needs of the firm. However, if your firm has multiple practice areas, ask if you can be staffed on a case in a different practice area. It may be that you really like M&A cases over litigation, or product liability litigation over personal injury litigation. In determining which practice areas you enjoy, it can help you focus or find opportunities in those areas.

Work-life balance tends to be a buzz word that is hard to put into practice. As you review the past year, evaluate your case load and the impact on your work-life balance. Billable hours are a fact of defense life. To meet the yearly required billable hours, it will require a particular number of cases that are on your docket. However, it may be that you have too many cases on your docket or not quite enough to comfortably meet your hour requirement. Having tangible data will allow you to advocate for yourself either way. You can tell your managing partner that you need more work, you currently have a quantity of cases that you can manage but do not have the capacity to take on additional matters without work product suffering, or that you have too many matters to successfully handle the day-to-day. Most people find it harder to say they have too much work in fear that future work will not be assigned. By having an up-to-date case list and a master project list, you can actively show the amount of work you have been doing. It may be that you can ask for a first-year attorney to help draft initial discovery responses or a paralegal to help manage experts. But having a tangible list will allow you support your position and explain your plan of action.

Most attorneys work in a particular practice area and often do not interact with attorneys in other practice areas within their firm. However, when partnership consideration begins, all the partners in the firm get a vote, not just the partners in your practice area. As a young attorney, make it a point to meet other people in different practices areas and in different offices (if your firm has multiple offices). It may feel weird walking into a random partner’s office and asking them to lunch, but most are willing to have lunch/grab coffee. If you have a good relationship with your staff, an easy first step is asking your secretary which partner you should approach first. Often staff know who is more willing to meet/mentor young lawyers and the best time to approach and ask (asking during the middle of trial prep for the biggest trial of the year will often get you a no or not now even from the nicest of partners). By slowly introducing yourself to different partners, more people will be able to advocate for you in partnership meetings. It will also allow you to ask for additional work or opportunities in other areas if that is one of your goals for the year.

The lawyer community is quite small. As such, it is important to build your reputation outside of your firm. Although young lawyers often feel they do not have time to attend local bar organizations or join a defense bar like DRI, these organizations are invaluable to building a network. Not only do these organizations provide contacts for future clients, they also provide a basis for friendship that transcends firm life. Learning how other firms manage their organizations can help you appreciate aspects of your own firm or realize that another firm is a better fit. It is not enough to simply be a member of a defense organization. Make it a point this year to attend one event, a happy hour, a conference, write for a publication, or give a speech. The benefits will be ten-fold but take time to grow. Becoming involved as a young lawyer will help you establish yourself and build your brand.

A new year is an opportunity for new growth. Every attorney is responsible for building their own career and as a result careers are varied and change over the course of a lifetime. In determining your goals/resolutions for the new year, make sure they are concrete, specific, actionable, and achievable within the year. Simply saying I want to meet more people will likely not result in you meeting your goal because it is neither specific nor concrete. But having a goal to go to lunch once a month with an attorney in a different practice area is specific enough to accomplish. You may have the long-term goal of being first chair in a trial, but that may not happen this year or for several years. However, taking an expert deposition, helping a team prepare trial outlines, or attending a mediation may be goals that are achievable within the year. These short-term goals are stepping stones to a longer-term goal. Some potential goals that meet the above are: 1) go to lunch once a month with attorneys in a different practice group; 2) ask for a case in X practice area; 3) take an expert deposition; 4) go into the office 3x a week (or conversely work from home 3x a week); 5) take a vacation with your family; 6) attend a DRI conference; etc.

Goals and resolutions often feel unachievable because they are not based in reality or are based in a fantasy self that does not yet exist. Additionally, there are many things in the law that attorneys have no control over—the actions of a judge, the statements a client previously made, and the hostility of opposing counsel. But, reviewing your practice yearly and determining what you want to focus on the upcoming year, you will have some control over your career, and this will help you build your reputation/brand. Regardless of the past, a new year is a new billable year and is full of possibilities. Don’t be afraid to advocate for yourself—it is great practice for advocating for others.

Summary

1. Review the past year and write a list of all your contributions and activities, a master project list.

2. Determine any gaps/deficiencies in your master project list and make a short-term goal of filling those gaps.

3. Update your case list.

4. Determine your main practice areas, and whether you might want to change.

5. Determine your case load and impact on work-life balance.

6. Meet partners/others in your firm.

7. Join and participate in professional organizations.

Brianna Weis is a fourth-year attorney with Hartline Barger, LLP in Dallas, Texas. Her main practice areas are personal injury litigation and vehicle warranty litigation. She is a co-chair of the Young Lawyer Publications Subcommittee for the Briefcase. Brianna is involved with DRI Young Lawyers, DRI Women in the Law, and Dallas Association of Young Lawyers.

Brianna Weis is a fourth-year attorney with Hartline Barger, LLP in Dallas, Texas. Her main practice areas are personal injury litigation and vehicle warranty litigation. She is a co-chair of the Young Lawyer Publications Subcommittee for the Briefcase. Brianna is involved with DRI Young Lawyers, DRI Women in the Law, and Dallas Association of Young Lawyers.

Interested in joining Young Lawyers Committee? Click here for more information.