Registration Information

EARLY REGISTRATION*

DRI Member Pricing: $995

Non-Member Pricing: $1,295

REGULAR REGISTRATION*

DRI Member Pricing: $1,295

Non-Member Pricing: $1,595

GOVERNMENT MEMBER

Early Bird Pricing: $695

Regular Pricing: $995

Register by November 7, 2022 to receive the early registration rate.

*If your membership recently lapsed, please renew your membership prior to registering to ensure you receive your discounted member rate. If you would like to join DRI to receive the member pricing and see the benefits of becoming a member, click here to go to the Application page.

GROUP REGISTRATION (Non-Sponsor)**

Pricing: $895 per person

**Group registration is for registering 5 or more attendees, members and non-members. There is one free registration with every 10 registrations. You must lock in the rate three weeks prior to the seminar. If you want to register for the group pricing, please send an email to rstiner@dri.org (online registration is not available for this offering).

Financial Aid Policy

Individuals who demonstrate need may receive limited financial aid to attend DRI CLE programs.

Review the Policy (PDF)

Agenda with Speakers

*Schedule and Speakers subject to change

Wednesday, December 7, 2022

| Time (Eastern) |

Session Description |

| 1:00 p.m. |

Registration |

| 3:00 p.m. |

Gazing into the Crystal Ball – Autonomous Vehicles, Climate Change, Biometrics, PFAS and Statutory Damages

Gazing Into The Crystal Ball – An Examination of Cutting-Edge Coverage Issues. The world is ever changing. New laws, new technologies and new liabilities are arriving at an exponential rate. So too are the resulting coverage issues, some of which relate to existing law and some of which are charting new territory. This presentation will examine five cutting-edge coverage issues – climate change, perfluorochemicals (i.e., PFAS), autonomous vehicles, biometrics and statutory damages. Join us as we gaze into the future and be prepared for how to handle these emerging coverage issues.

Patrick E. Winters, Plunkett Cooney, Bloomfield Hills, MI

John Danenberger, State Farm, Bloomington, IL

Martin P. Lavelle, Travelers, Hartford, CT |

| 4:00 p.m. |

ESG - Its Impact on Claims and Beyond

The Role of Insurance in Effectuating Change – as insurance losses continue to rise what role does insurance have in effectuating change and what will its experience be if the industry chooses not to? This presentation will focus on the intersection between insurance and environmental, social and governance (ESG) issues and will discuss the benefits and pitfalls of being proactive versus reactive in the current, evolving risk and litigation environment.

William A. Bulfer, Teague Campbell, Asheville, NC

Sarannah McMurtry, Acceptance Insurance, Nashville, TN |

| 5:00 p.m. |

Insurance Law Committee Meeting (open to all)

|

| 5:30 p.m. |

Women's Networking Meet and Greet

|

| 6:00 p.m. |

Networking/Cocktail Reception |

| 7:30 p.m. |

Dine-Arounds (on your own)

Join colleagues and friends at selected restaurants for dinner. Please sign up here for your preferred restaurant. Must be a registered seminar attendee to attend.

|

Thursday, December 8, 2022

| Time (Eastern) |

Session Description |

| 6:00 a.m. |

DRI for Life: Mat Pilates with Monica McMahon

Monica McMahon of Get Fit Retreats will guide attendees for an hour-long mat pilates session. Bring a towel or your own mat and join fellow ICP and Professional Liability attendees for this complimentary session.

|

| 7:00 a.m. |

Registration and Continental Breakfast |

| 7:00 a.m. |

First-Time Attendees Breakfast

|

| 8:00 a.m. |

Welcome and Introduction

Daniel W. Gerber, Gerber Ciano Kelly, Buffalo, NY

Matthew M. Haar, Saul Ewing, Harrisburg, PA |

| 8:15 a.m. |

Top 10 Cases of 2022

Mr. Foy will provide insights and commentary on the Top 10 insurance coverage decisions of the year, from coverage for COVID-19 business interruption claims, to the duty to defend opioid and lead paint suits, together with other key cases from across the country addressing coverage issues ranging from “bad faith” to those resulting from Biometric Information Privacy Act litigation. Prognostications for what the insurance industry may expect in 2023 will also be addressed.

Matthew S. Foy, Gordon & Rees, San Francisco, CA |

| 9:15 a.m. |

Catastrophic Losses – Insight on Champlain Tower

This session will examine the issues faced by the carriers and coverage counsel involved in the Surfside Condominium Collapse Litigation, which resulted in more than a billion-dollar global settlement before the one-year anniversary of the collapse. From issues related to the various subclasses of claimants, theories of liability, priority of coverage, subrogation, outdated condominium laws, to timed policy limit demands, this presentation will focus on the nuances of catastrophic losses and the implications for future litigation.

Kathy Maus, Butler Weihmuller Katz, Tallahassee, FL

Ilana B. Olman, Segal McCambridge, Fort Lauderdale, FL |

| 10:15 a.m. |

Coffee Break |

| 10:30 a.m. |

In or Out? Intervention, Abstention and Other Coverage Issues

Few, if any, areas of life were left untouched by the COVID-19 pandemic. Over the past three years, we have noticed a trend of federal courts electing to abstain when they are presented with insurance-coverage questions brought under the federal Declaratory Judgment Act. Hear from our speakers about issues related to coverage suits under the Act, the law of abstention, and the procedural device of intervention in which insurers may be able to develop a factual record that could obviate the need for separate proceedings.

E. Ford Stephens, Christian & Barton, Richmond, VA

Alexander G. Henlin, Sulloway & Hollis, Concord, NH |

| 11:30 a.m. |

Lunch (on your own) |

| 1:15 p.m. |

Mediation – Buying Your Peace: Effectively Mediating the Insurance Coverage Dispute

This session will provide insights on how to prepare for and mediate effectively in insurance coverage disputes. The speakers will discuss all aspects of the mediation process including pre-session calls, mediation submissions, opening sessions and separate caucuses with insights as to how to strategically approach each aspect of the process. The session will be compiled based on questions from the audience provided in advance and at the session.

Andrew Nadolna, JAMS, New York, NY

Jeff Kichaven, Kichaven Commercial Mediation, Los Angeles, CA |

| 2:15 p.m. |

What Keeps You Up at Night: Tips and Traps for Outside Counsel

Our panel of highly experienced in-house counsel will share their views on what makes their outside counsel stand out as valued partners, including practical advice on selecting outside counsel and ensuring that outside counsel: understand the client and its business objectives; partner with us to set the strategy for each matter; engage in thorough and timely communications and status updates; ensure compliance with budgets; avoid surprises; and provide strong recommendations.

Moderator

Rhonda J. Tobin, Robinson & Cole, Hartford, CT

Naomi Kinderman, W. R. Berkley Corporation, Greenwich, CT

Megan Zurn, Axa XL, Atlanta, GA

Sam Weisgarber, Sentry Insurance, Madison, WI |

| 3:15 p.m. |

Coffee Break |

| 6:00 p.m. |

Networking/Cocktail Reception

|

| 7:30 p.m. |

Dine-Arounds (on your own)

Join colleagues and friends at selected restaurants for dinner. Please sign up here for your preferred restaurant. Must be a registered seminar attendee to attend.

|

Friday, December 9, 2022

| Time (Eastern) |

Session Description |

| 6:00 a.m. |

DRI for Life: Yoga with Monica McMahon

Monica McMahon of Get Fit Retreats will guide attendees for an hour-long yoga session. Bring a towel or your own mat and join fellow ICP and Professional Liability attendees for this complimentary session.

|

| 8:00 a.m. |

Registration and Continental Breakfast |

| 8:45 a.m. |

Welcome and Introduction

Elaine M. Pohl, Plunkett Cooney, Bloomfield Hills, MI

|

| 9:00 a.m. |

Hot Topics in Bad Faith: Consent Judgments, Problem States, Time Limited Demands and More

Plaintiff lawyers routinely manipulate the claims process to turn an insurance policy with minimal coverage limits into an insurance policy with no limits. The threat of bad faith causes insurers to settle claims that, perhaps, should not be settled and pay more to settle claims than, perhaps, ought to be paid. This presentation will focus on hot topics in bad faith law. This includes consent judgments, demand letters, appraisal of property insurance claims, and some recent developments.

Matthew Lavisky, Butler Weihmuller Katz, Tampa, FL

Aaron Singer, The Harford, Hartford, CT |

| 10:00 a.m. |

Managing General Agents: What You Need to Know for Your Practice

MGAs are one of the fastest growing segments of the insurance industry. Policies are increasingly being issued by MGAs, which carriers trust and use across a growing number of insurance lines. This panel will provide insight into capacity, fronting, reinsurance, claims, and best practices for working with MGAs."

Moderator

Albert Alikin, Freeman Mathis & Gary LLP, Los Angeles, CA

Christopher Butler, Bowhead Specialty, New York, NY

Meg McBurney, Starfish Specialty Insurance Services, LLC, New Jersey, NJ

Tom Kang, Converge, Los Angeles, CA |

| 11:00 a.m. |

Coffee Break |

| 11:15 a.m. |

Ethical Issues with Cybersecurity

The presentation focuses on ethical obligations of lawyers with regard to cybersecurity. It also discusses some of the statutory and regulatory cybersecurity requirements to which lawyers and other professionals can be subject, the increasing number of states imposing mandatory cybersecurity training through CLE requirements, and the exposure to common law negligence claims arising from situations where reasonable cybersecurity procedures were not instituted or followed.

Laurie Kamaiko, Saul Ewing, New York, NY

Ronald Minkoff, Frankfurt Kurnit Klein & Selz PC, New York, NY |

| 12:15 p.m. |

Adjourn

|

On-Demand

NEW in 2022 – 4 Additional On-Demand Programs Included With Every Seminar!

CLE Credit will be sought from every state requiring CLE hours in elimination of bias/diversity and inclusion, ethics, substance abuse/mental health and law practice management. The CLE grid will provide updated information concerning which courses have been approved by which states and for which credits. For states not requiring these special credits, general education credits will be sought.

Diversity/Elimination of Bias in the Profession

Batson v. Kentucky and its progeny were meant to eliminate bias in jury selection. But has that happened? This program will address that question and discuss issues of bias in the courtroom more broadly and will challenge viewers to recognize their own biases and to learn how those biases could affect their assessment of potential jurors, witnesses, judges, and adversaries. The program also will provide viewers with skills on how to identify the biases of potential jurors and how those biases could come into play during deliberations.

Stacy Douglas, Everett Dorey LLP, Irvine, CA

Gary Howard, Bradley, Birmingham, AL

Ethics

Investigating claims and lawsuits often requires interviews with employees. Corporate in-house attorneys and their outside counsel need to be able to identify potential conflicts of interest and confidentiality issues with employees who may leave their employment and become opposing counsel’s best witness.

Kristie S. Crawford, Brown & James, Springfield, MO

Lauren Buford, Walgreen Co., Deerfield, Illinois 60015.

Mental Health & Attorney Wellness

Study after study suggests that lawyers aren’t happy. Continued unhappiness impacts performance, relationships, and physical health. That’s the bad news. The good news is that research proven interventions exist that increase happiness without requiring a radical change in circumstances. Even a slight increase in happiness has a lasting impact on both your current performance and resilience, not to mention, happier just feels better. This program will quickly, efficiently, and practically explain why happiness matters and offer tools you can use today to work, lead, and live happier.

Rebecca Morrison, Aldie VA

Law Practice Management

Law firms must operate more efficiently to ensure they can deliver high-quality services, handle more volume and maintain a profit margin in today’s climate of rate pressure and rising costs. Understanding Key Performance Indicators and law firm analytics concerning financial, operational and client service data are key to mastering law firm performance management. This presentation will address methods to collect information necessary for evaluating key areas of performance, identify tools and techniques to analyze data and generate action items and more.

Brian Kennel, PerformLaw, New Orleans, LA

Jan Sander, PerformLaw, New Orleans, LA

Sean Kennel, PerformLaw, New Orleans, LA

Hotel and Travel Information

A limited number of discounted hotel rooms have been made available at the Sheraton New York Times Square Hotel, 811 7th Avenue 53rd Street, New York, NY 10019. Take advantage of the group rate of $399.00 Single/Double in one of two ways:

The hotel block is limited and rooms and rates are available on a first-come, first-served basis. You must make reservations by November 7, 2022 to be eligible for the hotel’s group rate. Requests for reservations made after that date are subject to room and rate availability. A small portion of your room rate offsets the costs of the seminar.

Travel Discounts: DRI is pleased to announce that discounted air fares are available on various major air carriers for DRI seminar attendees. To receive these discounts, please contact Direct Travel Ltd., DRI’s official travel provider, at 800.840.0908. If you would like to have access to the DRI online travel booking tool, you must complete a Business Travel Profile form at www.dt.com. Within 24 business hours, you will receive information on accessing the system.

CLE Information

Earn up to 10.00 hours of continuing legal education hours, including 1 hour of ethics credit from this seminar.

Insurance Coverage and Practice CLE Grid (PDF)

DRI's Insurance Coverage and Practice Symposium is proudly sponsored by:

If you would like to contact DRI about seminar sponsorship opportunities, including pricing, or to reserve a spot, please go to Advertising and Sponsorship.

DRI Cares

New Yorkers for Children (NYFC)

New Yorkers for Children (NYFC) improves the well-being of youth and families in the child welfare system with an emphasis on older youth aging out of the system. NYFC provides direct education, financial and emotional support and develops programs to fill gaps in the system in partnership with foster care agencies, community organizations, and the NYC Administration for Children’s Services. Donations will be collected through the DRI Foundation, and a donation will be made to New Yorkers for Children on behalf of the DRI Foundation.

New Yorkers for Children (NYFC) improves the well-being of youth and families in the child welfare system with an emphasis on older youth aging out of the system. NYFC provides direct education, financial and emotional support and develops programs to fill gaps in the system in partnership with foster care agencies, community organizations, and the NYC Administration for Children’s Services. Donations will be collected through the DRI Foundation, and a donation will be made to New Yorkers for Children on behalf of the DRI Foundation.

To donate online:

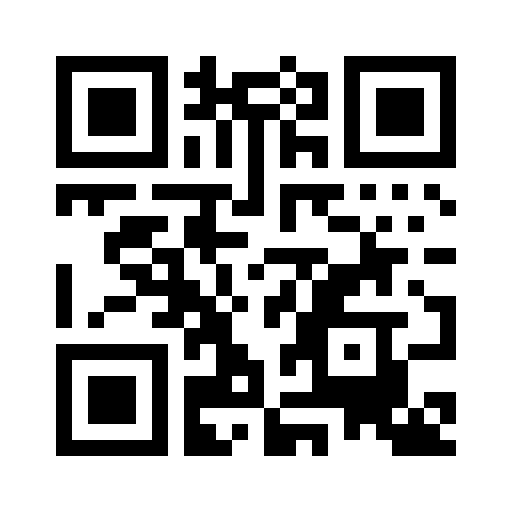

- Click the "Donate" button or scan the QR code below.

- If you have an account with DRI, log in. Use the same login that you registered for this seminar.

- If you do not have an account with DRI, create a guest account.

- Select from one of the gift amounts or set your own amount. The default value is $100.

- Select “Insurance Law” from "My SLC/Region" dropdown box.

- Click “Submit Donation.”

- The page will refresh. Click “View Cart” to checkout.

- Enter your credit card information and click “Submit Order” once all required information is entered.

Donate

If you have any questions or concerns regarding DRI programs, please contact DRI Customer Service at 312.795.1101 or custservice@dri.org.